Oil Through Sanctions: How Hundreds of Tankers Easily Evade Western Restrictions on Russian Hydrocarbons

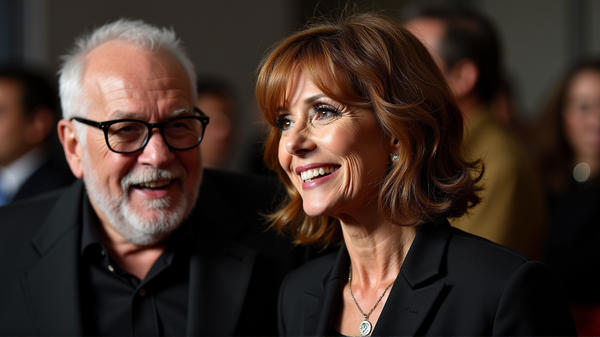

Mikhail Krutikhin, an oil and gas market analyst, explained to NV why the $60 price cap does not stem the flow of petrodollars into the budget of the aggressor country.

Russian exporters have mastered the art of circumventing the so-called $60 per barrel price cap imposed by Western governments as a restriction on oil from Russia. This confidence is backed by oil and gas expert Mikhail Krutikhin, whose insights were highlighted in NV’s article, “War Tax: How Putin 'Milks' His Oilmen and Why This Trick Won't Work with Gas Suppliers.”

The key to this evasion is the use of a “chain of intermediaries.” Initially, the oil is sold at a price below $60 per barrel. This tanker, equipped with all the necessary documentation, can even have its cargo insured by a member of the London Club of Insurers.

However, en route to the buyer, often in India, the value of the tanker’s cargo begins to increase as it is resold multiple times between shell companies. According to Krutikhin, dozens of firms, some established by corrupt Russian officials and others by the oil exporters themselves, may be involved in these schemes. Consequently, by the time the tanker reaches its destination, the “black gold” fetches around $75-$78 per barrel.

Should such a vessel be caught transporting oil priced above the cap, sanctions come into play. But, as Krutikhin points out, apprehending, proving, and punishing such violations is beyond the administrative capabilities of the United States. Hundreds of ships are involved, and tracking how and when the oil price exceeds the cap is challenging.

“So far, fewer than 50 tankers have been penalized. But this is laughable compared to the hundreds of tankers engaged in such operations,” Krutikhin concludes.