"The Complex Path to Confiscating Frozen Russian Assets: Challenges and Implications for Ukraine"

As of January 17, 2024, the international community, particularly Western nations, remain engaged in a complex and unprecedented discussion regarding the confiscation of Russian assets, estimated at $300 billion, to assist Ukraine. This deliberation was notably highlighted at the recent World Economic Forum in Davos, as reported by Reuters, citing statements from high-ranking officials from the United States and European Union countries.

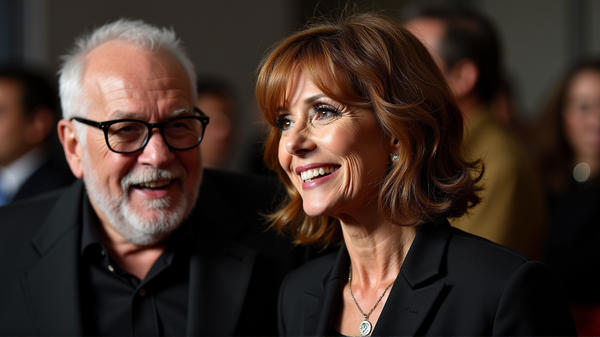

Penny Pritzker, the U.S. Special Representative for Economic Recovery in Ukraine, emphasized that no decisions have been made yet. She pointed out that if such a decision is taken, it must be a collective one. Pritzker underscored the necessity of involving a substantial number of legal experts to develop a mechanism for the confiscation of Russian assets. She cautioned against viewing this potential confiscation as a cure-all solution for Kiev, stating that real efforts are being made towards this direction, but the path to a tangible result is still long.

A significant proportion of these frozen Russian assets is held in Euroclear, a depository in Belgium. Belgian Prime Minister Alexander De Croo expressed openness to the idea of confiscation but stressed the need for a clear legal framework. He emphasized the importance of finding a legal basis for transferring these assets to Ukraine without destabilizing the global financial system.

De Croo also highlighted a unique aspect of these frozen assets: the impending maturity of securities owned by the Russian central bank, which would convert these assets into cash. This conversion process is subject to a 25% tax in Belgium. De Croo mentioned that any taxable income generated in this manner would be earmarked for Ukraine.

In 2023, the tax on frozen Russian assets in Belgium amounted to approximately 1.3 billion euros, and it is expected to increase to around 1.7 billion euros in 2024.

The discussion surrounding the confiscation of Russian assets is not only a legal and financial challenge but also a geopolitical one. It involves navigating a complex web of international laws, treaties, and financial regulations. Furthermore, it raises ethical and political questions about the precedent such actions might set in international relations and global finance.

The situation is further complicated by the need to balance the legal and moral obligation to assist Ukraine with the potential repercussions on the global financial system. There is also the question of how these assets, once confiscated, would be effectively and fairly used to aid Ukraine.

As these discussions continue, it is evident that the confiscation of Russian assets, while potentially beneficial for Ukraine, is not a straightforward solution. It requires careful consideration of various legal, financial, and geopolitical factors. The international community must work collaboratively to ensure that any actions taken are legally sound, ethically justified, and effective in providing tangible aid to Ukraine.

In conclusion, while the idea of using frozen Russian assets to support Ukraine garners significant support, it is clear that the road to actualizing this concept is fraught with complexities. The international community must proceed with caution, ensuring that any measures taken are within the bounds of international law and do not inadvertently destabilize the global financial system. The situation underscores the intricate interplay of law, ethics, and politics in addressing the repercussions of international conflicts and the pursuit of justice and reparations.